Cracks in the Wealth Extraction System

Wealthy people for wealth redistribution!? Is this a quirky “man bites dog” story? Or a curious symptom of late-stage capitalism where the beneficiaries of extreme wealth inequality speak out against the system that concentrates wealth and makes them financially wealthy in the first place?

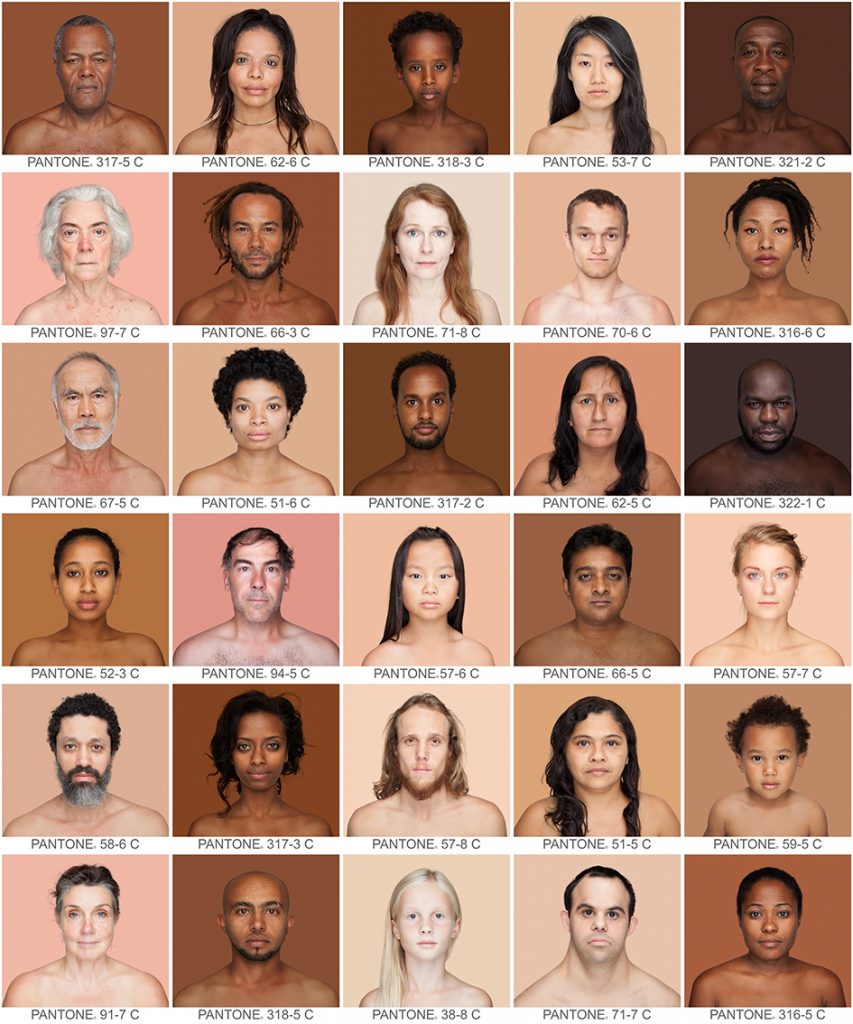

These trends are flickers of possibilities, cracks in what sometimes appears to be an impermeable system of concentrated wealth and power. These dissenters of the power elite, who by no means constitute a majority of the ultra-wealthy, are working together with promising movements to address the harms of extreme inequality, racial capitalism, and the need for reparations and healing.

Here are a few of these signs of the time:

- A veteran wealth advisor starts a new firm to help wealthy clients entirely rethink their relationship to wealth. She sparks a “progressive advisor’s movement,” including the tax attorneys, accountants, wealth managers, and family office staffers, to join to a higher purpose: aiding their clients to deploy wealth to heal the harms caused by wealth extraction.

- A segment of these wealth managers, members of the trusted couture of enablers that serve the ultra-wealthy, are defecting, blowing the whistle on systemic abuses and helping craft laws to close the tax loopholes that they helped to create.

- Wealth holders are pledging to radically redistribute their wealth, seeking ways to share decision-making and power to “decolonize wealth.”

- Former philanthropists are calling for “taxing the rich” through the endowments of foundations.

- Wealthy individuals and families are forgoing their privacy – sometimes facing belittlement and attack – to publicly speak out in favor of higher taxes on the wealthy, higher wages for workers, and reforms in the laws governing philanthropy.

While there are historical examples of random “class traitors,” rejecting wealth and its trappings, what’s new about this new movement is the scale and institutional formation, what organizer Michael Gast has described as an unprecedented ecosystem of “organizing the rich” activity.

Driven by Extreme Inequality and Climate Disruption

We are living through a period of extraordinary wealth inequality, with the lion’s share of income and wealth gains of the last two decades flowing not just to the richest 1 percent, but to the richest 0.1 percent, those with assets north of $30 million. On March 18th, 2020, at the beginning of COVID-19 pandemic, there were 615 hundred billionaires in the U.S. with a total combined wealth of $2.9 trillion. Four years later, on March 18, 2024, there were 737 billionaires with total combined wealth of $5.5 trillion, a four-year gain of 88 percent.

These trends have given rise to a wide variety of social disruptions, both radical and reactionary. On the positive side, there is a generation of wealth holders that are rejecting the historical socialization of the ultra-wealthy to hold onto wealth and create multi-generational dynastic institutions to protect, manage, and hoard assets. Propelled by the harms of extreme inequality, racial injustice, and climate disruption, these wealth holders are also rejecting traditional philanthropy, with its focus on creating perpetual legacy foundations and institutions. Instead, they are aggressively moving money, often through intermediaries that share decision-making, and to grassroots social change movements.

Members of wealth networks like Resource Generation, Solidaire, Threshold, are engaged in peer-to-peer support to boldly redistribute. Resource Generation (RG) encourages members to reject “making wealth off of wealth” and take a redistribution pledge to give away “all or almost all inherited wealth and/or excess income to social justice movements.”

RG also encourages members to move capital out of traditional Wall Street investments in corporations and “practice regenerative, values-aligned strategies for investing our resources to build a world where land, wealth, and power are shared equitably.” They point to opportunities for direct loans and investments in high-impact funds and projects.

Resource Generation is rethinking how it relates to financial advisers, helping their members navigate a field that is biased against redistribution. To be included on their referral list, the organization is now inviting financial advisers to fill out a survey that includes how they would respond to various scenarios, including a client that wants to give away 10 percent of their wealth every year for 10 years to racial justice groups. “Believe it or not, there is a growing market for anti-capitalist wealth advisers,” says Nora Leccese of Resource Generation.

A number of these networks have joined together to change the laws governing philanthropic giving. They are rejecting the ways that philanthropy has been captured by billionaire donors, some of whom are deploying philanthropy as a taxpayer-subsidized form of private power and influence. An emerging “donor revolt for charity reform” is pressing for law changes to accelerate payouts, increase transparency, and shut down the tax avoidance and self-dealing aspects of philanthropy.

Cracks in the Wealth Defense Industry

The wealth defense industry are the professional enablers that serve the families of the ultra-wealthy. They are trained tax attorneys, accountants, members of the Society for Trust and Estate Planners, staffers at family offices. Their north star is to aid families in maximizing wealth accumulation, minimizing taxation, and fostering dynastic succession, ensuring that as much wealth as possible flows down a narrow blood line to future generations.

But there are defectors from the industry’s norms. Stephanie Brobbey, a veteran wealth manager based in London, formed her own advisory firm, Good Ancestor Movement. In an interview for YES Magazine, Brobbey told me, “We are pioneering a radically different path for wealth stewardship – to move from a system of wealth extraction to a regenerative economy where wealth is more fairly distributed.”

“We ask our clients,” Brobbey said, “What harm may have been caused in the process of the extraction or ongoing accumulation of this wealth? Were there groups of people [who] were harmed? Was there ecological harm? And what, based on this, is imperative for you to do?”

The answer is not always philanthropy. Redistribution outside philanthropy can take the form of paying taxes – at the local, state and federal level. It can mean transferring assets into community-controlled ventures, forming partnerships with social movements and communities that have been excluded from wealth for generations.

“What really inspires me is the potential of the great wealth transfer,” says Brobbey, referring to the trillions passing from the Baby Boomer generation to their children and grandchildren, mostly in the upper canopy of the wealth forest. “We want to be ready and optimistic that there will be people who want to radically redistribute this wealth for repair and regeneration. Our clients will be partners in pursuing a radically different vision of the world,” she adds. “This is a lifelong journey of healing for all of us as we try to recover a lost story – or write a new economic story of justice and collective liberation.”

Organizing the Wealthy to Change the Rules

A segment of wealth holders are using their wealth, status and influence to change the laws that are tipped in favor of asset owners at the expense of wage earners. The Patriotic Millionaires includes several hundred high net worth individuals that speak out for policies to increase taxes on themselves. They actively lobby for taxes on higher incomes and wealth, as part of a comprehensive plan to revamp the tax code

The Patriotic Millionaires have spawned sister efforts in the UK, Europe and other parts of the world. At the 2024 meeting of the World Economic Forum at Davos, more than 250 billionaires and millionaires, in an open letter, urged lawmakers in their nation states to “tax our extreme wealth.”

These networks are activated at the local level as well, with wealthy individuals pressing for state level wealth taxes. In Vermont, over 35 millionaires signed an open letter to state legislators in support of a 3 percent higher income tax rate on incomes over $500,000 to fund affordable housing programs. The letter states: “Here in Vermont, we take care of our neighbors and form close relationships that transcend economic circumstances. Public investment, funded through tax revenue, is necessary to amplify these community efforts and fund programs that strengthen our communities….[It is] important for Vermonters – especially our state legislators – to know that many of the people who will pay these taxes support them…We love living in Vermont and appreciate the public goods that taxes provide.”

The signers include Ben Cohen and Jerry Greenfield of Ben and Jerry’s Ice Cream, Renee Reiner, co-owner of Phoenix Books, green energy entrepreneurs Duane Peterson, David Blittersdorf, and Alan Newman, of Gardener’s Supply Company, and Magic Hat Brewing Company.

Four decades of growing inequality has led to interesting shifts in public opinion, including the attitudes of the wealthy. A majority of households in G-20 countries with more than $1 million in wealth support higher taxes on themselves. January 2024 polling found 74 percent of millionaire households support wealth taxes to address the cost of living crisis and improve public services. 72% think that extreme wealth helps buy political influence, and 54% think that extreme wealth is a threat to democracy itself.

The power of today’s billionaires – and their enablers in the wealth defense industry – are formidable. They command huge pools of resources and have captured the political systems, in oligarchic fashion, all over the world. Yet the cracks in the system are appearing, a harbinger of the new possibilities for decolonizing wealth and building regenerative economies to serve human, and more-than-human, needs and flourishing.

Return to Kosmos Edition 24, Issue 3, Healing Wealth